Five Key Commodities On Our Radar in 2026

Check out this 2025 review that also details out strategic outlook for commodities in 2026.

Happy New Year to all of you. We are looking forward to an event-packed 2026!

In the first of our three-part series on commodities to kick off the year, we want to recap the main drivers behind the five commodities that were most critical.

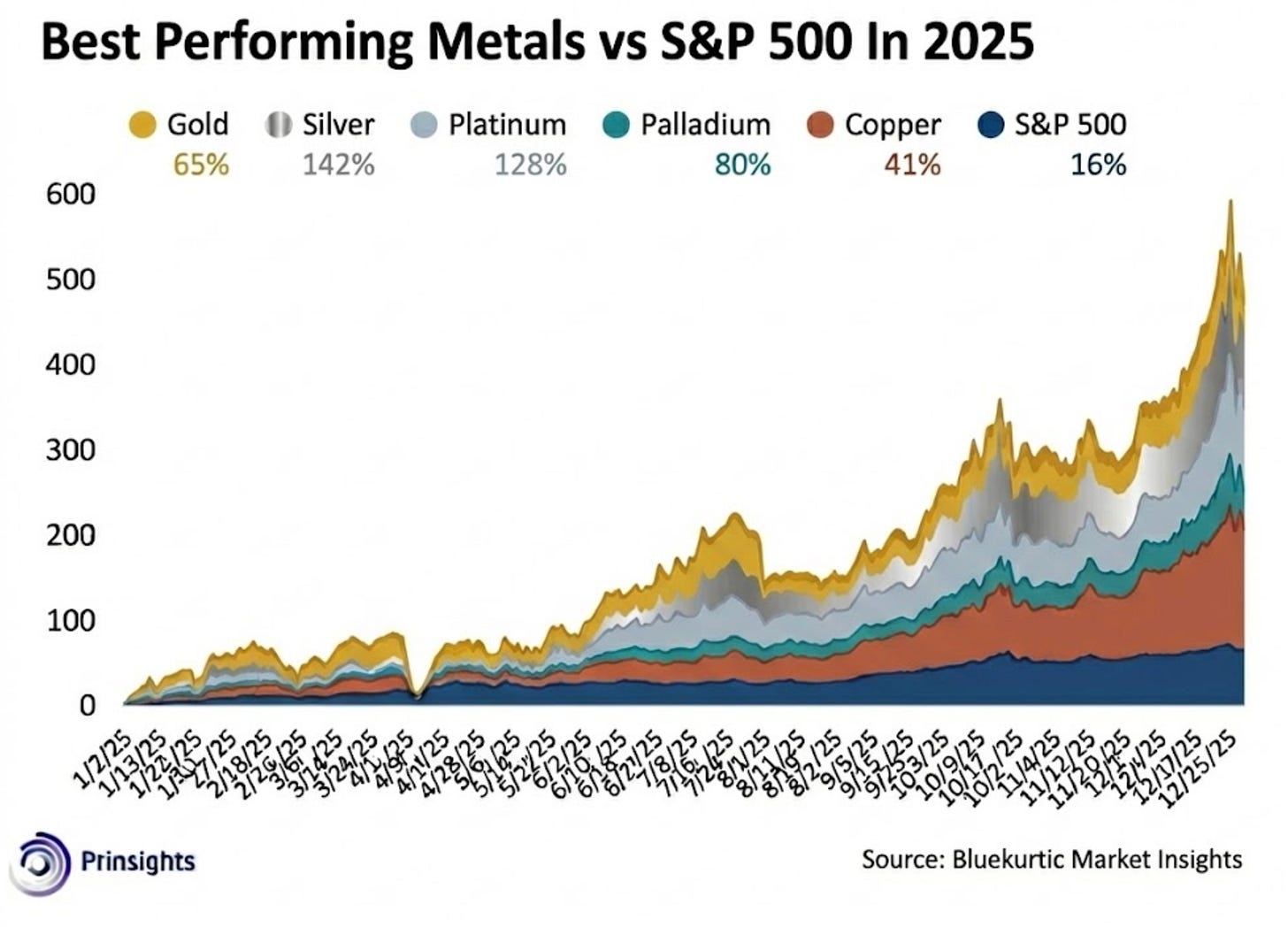

2025 was an outstanding year for commodities. Certain commodities significantly outperformed the SP500’s 16% return for 2025. They left the dollar, which dropped by 10% during 2025, in the dust. Gold rallied 65%. Silver surged nearly 150%. Platinum jumped 128%.

Around the world, governments have finally come to terms with the fact that existing supply can’t meet the deluge of demand for metals, minerals and processed elements.

The last time we experienced this type of broad-based move in the commodities space was during the 1970s. Nixon closed the gold window in 1971, Arab oil producers imposed embargoes in 1973, oil prices quadrupled, and inflation hit double-digits.

There is a historical difference marking this period. These 2025 rallies happened without an oil shock and with inflation at 2.7%. Oil prices fell by 20%, the highest drop since Covid.

We are seeing simultaneous, structural shifts in multiple drivers across high-quality, stable-jurisdictions, at the same time as an accelerated demand for monetary sovereignty as governments look to harden national defenses and energy independence. In many ways, these forces are moving more rapidly than supply can match.

Below, we detail the five commodities that are most critical heading into 2026 and worth your consideration for investment. We lay them out in terms of what unfolded in 2025, and then detail our outlook for the year ahead.

Silver

2025

Silver ended the year at $72, having hit an intraday record high of $84 in late December 2025. What made 2025 so pivotal for silver’s future prospects was a cocktail of factors driving the price. Industrial demand is at record highs. Current supply is running a five-year structural deficit. Governments are spending, or planning to spend, at a record scale to rebuild power grids and enhance energy infrastructure, which requires silver.

2026

That growing supply gap leaves the market exposed to squeezes. Plus, the majority of global silver is a by-product of copper, lead, and zinc mining. That means silver supply cannot respond directly to higher silver prices and related financial support.

China, one of the world’s largest silver refiners and consumers, expanded its export controls and licensing conditions across strategic metals and refined materials on January 1. These stricter directives will amplify uncertainty around future silver flows and could limit Chinese exports.

Existing silver mines are facing declining ore grades, meaning more material must be mined to yield the same amount of silver. Developing new primary silver mines can take up to 8-12 years due to permitting challenges and significant capital requirements. There are no major additions expected in the near term, as we recently detailed for Founders+ readers.

This backdrop of tight supply and rising demand will push prices higher and favor miners closer to high-quality production.

Uranium

2025

Last year saw heightened support for the nuclear sector in policy. In October 2025, the U.S. government struck a landmark $80 billion partnership with Westinghouse Electric Company (and its owners, Cameco Corporation and Brookfield Asset Management) to support the buildout of a new fleet of nuclear reactors over the next decade. That constitutes the first large-scale, U.S. government-backed recommitment to nuclear reactor construction in a generation.

Uranium demand has increased significantly in recent years, driven by renewed interest in nuclear power as a core source of baseload energy for AI-driven growth, grid expansion, and an emphasis on energy security. Uranium’s re-inclusion in the 2025 U.S. critical minerals list underscores geopolitical attention on this key energy fuel.

2026

Power utilities will work to extend reactor operating licenses and move to advance new reactor projects, including large Generation III+ reactors and small modular reactor designs for 2026. Energy generation companies are also resetting old contracts and lining up new fuel supply earlier. As a result, reactor design and technology choices made now carry long-term consequences. This situation favors companies with reactor platforms that align with secured Western fuel supply chains and those that can meet advanced processing and regulatory requirements.

This shift is taking place while roughly 40-45% of global uranium enrichment capacity remains controlled by Rosatom, the state-owned Russian conglomerate, even as U.S. and European utilities work to actively reduce reliance on Russian fuel services. Global uranium production remains concentrated in Russia, Kazakhstan and Canada, while U.S. domestic supply is a fraction of national reactor requirements.

Over the next 12 months, we are bullish on uranium, enrichment and nuclear technologies firms.

Copper

2025

As we detailed, copper closed over $12,000 per ton on the LME cash market for the first time on December 23, 2025. Demand grew faster than physical supply or inventories, which sit near multi-year lows, could keep up. Notably, copper hit the U.S. critical minerals list, China increased its copper reserves – and at a domestic level, U.S. power utilities increased their need assessments.

There was a growing ore grade decline across major mines stretching from South America to Asia with average grades in Chile, the country with the largest supply, down roughly 25-30% from early-2000s levels. Growing supply strain also came from recent outages at major copper sites, including labor disruptions at Las Bambas in Peru and water-related problems in northern Chile.

2026

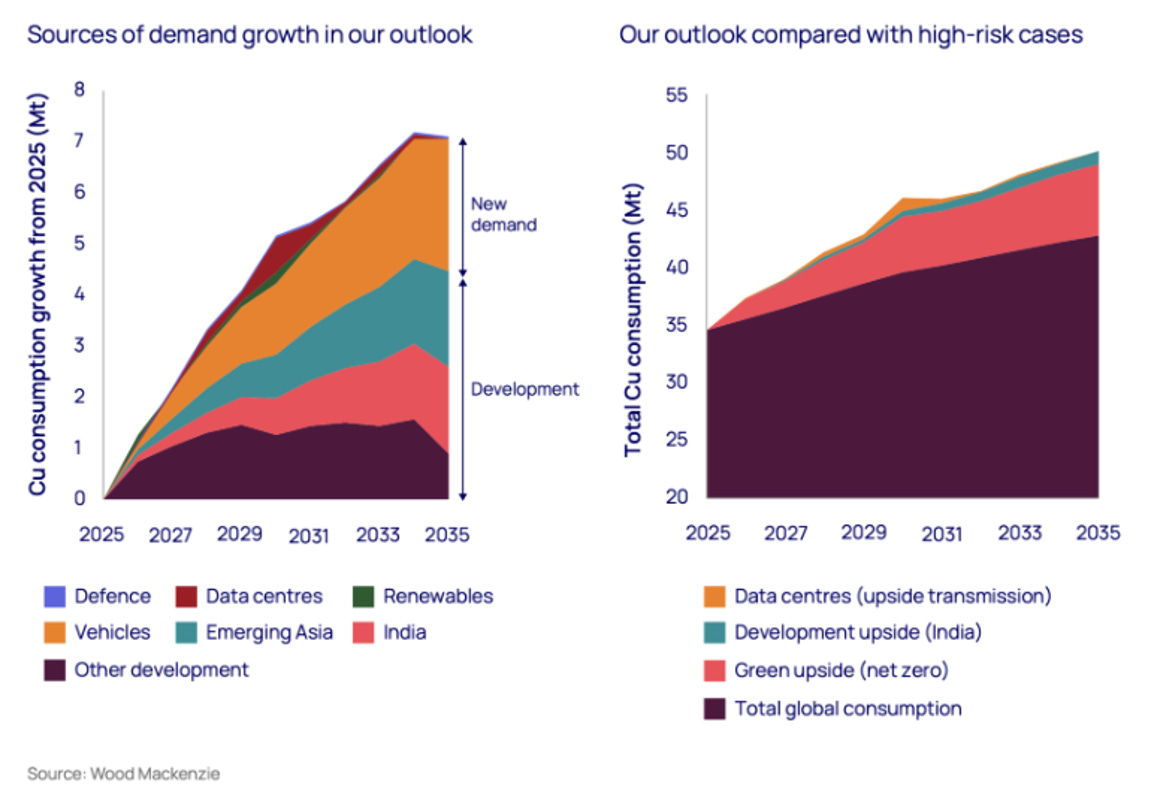

In 2026, expect copper scarcity to become a broader and more strategic problem, signaling an investment opportunity in junior miners that operate in neutral jurisdictions. Power grids, transmission lines, AI-data centers, and electrification projects remain the largest incremental sources of copper demand globally. Top producers in Chile and Peru remain constrained by declining ore grades and regulatory issues, while major approved greenfield projects will take years to add tonnage. The result is a growing structural imbalance that Wood Mackenzie reports could lead to a 250-300,000 annual deficit starting in 2026 over the following decade.

Based on these fundamental factors, we see copper prices and smelter plants rallying.

Platinum

2025

Platinum carries the precious-metal label, but its demand is driven primarily by physical need rather than macro variables, such as inflation trends or currency shifts.

The World Platinum Investment Council forecast a 700,000-ounce deficit for 2025, after deficits in 2023 and 2024. Compounding the matter further, Platinum does not have a diversified global production footprint, with about 70% of mined supply from South Africa and 10-12% from Russia.

In South Africa, power instability at state-owned utility Eskom has impacted output globally. Several producers lowered their 2026-2028 guidance levels due to power issues and rising costs. The reality is that above-ground supply sits at the lowest levels in half a decade. That means that any disruption in mine output or refined metal flow will directly impact prices.

2026

This year’s platinum demand is already baked into 2026 production plans and automakers’ manufacturing pipelines, leaving little buffer room for supply disruptions as things stand. What can move prices upward is problems with regional outflow.

The new U.S. “Phase 3” emissions-control rules for heavy-duty vehicles, petrochemical facilities, and refinery operations will expand the load on platinum-group metals (PGMs). Europe’s Euro 7 rules tighten emissions limits for new light-duty trucks in 2026 and for heavy-duty ones in 2027. This means catalytic systems must do more work and rely more heavily on PGMs to do it.

This is the fundamental disconnect as we enter 2026. The regulatory framework is getting stricter as mine supply is becoming less reliable. Demand for 2026 will increase due to regulatory, contractual, and scheduled plans. Yet supply can’t yet keep up.

The Western Hemisphere is increasingly strategic for PGMs.

We see upside in North and South American PGM miners throughout 2026.

Gold

2025

Gold first broke above $4,000 an ounce on October 8, 2025. It broke $4500 on Christmas Eve. That pattern was largely due to ongoing central bank buying that was unfolding regardless of price – along with renewed Western retail interest and six months of gold-ETF inflows.

Central banks bought approximately 950-1,050 metric tons of gold in 2025, or roughly 25% of total global gold demand. Yet, the global mine supply of about 3,700 tons, was up only about 1% year-on-year and remained below its 2018 peak, causing a structural deficit.

2026

Gold supply in 2026 remains constrained. The large mines that added capacity over the past two years, including Gold Fields’ Salares Norte in Chile and the Greenstone project in Canada along with B2Gold’s Goose project in Canada (which enters commercial production in 2026, ramping toward a planned capacity of roughly 300,000 ounces per year), were not enough to materially change global gold supply.

Global production is forecast to rise about 3,720–3,750 tons, according to research from Deutsche Bank. That increase amounts to 20–40 tons at most. Central banks alone have been absorbing close to 1,000 tons per year. To put this in perspective, the entire expected increase in mine supply for 2026 can be absorbed in a matter of weeks at the current buying pace. That’s why we remain positive on gold and miners.

Stay tuned! Our next outlook unpacks our six-factor model and provides our full 2026 forecasts and rankings for our top ten focus commodities for 2026. The analysis will be available for Premium and Founders+ subscribers only.

You can upgrade to a paid subscription here now and unlock all that we have to offer.