AUGUST ISSUE – Two Uranium Miners Set to Skyrocket on New Power Wars

Here’s why domestic and geopolitical conditions will push uranium prices higher – and two companies poised to benefit from the emerging trend. Plus, an exclusive interview with a uranium executive.

"If we are serious about replacing fossil fuels, we are going to need nuclear power, so the choice is stark: We can keep on merely talking about a carbon-free world, or we can go ahead and create one." – Peter Thiel, Technology Entrepreneur

First, I want to sincerely thank you for being a reader here. We value your consideration and most importantly your time.

This month, we are turning to the energy sector and a key driver behind nuclear power. The timing couldn’t be more crucial.

Western uranium mining companies just had a stop-the-press moment.

That’s because Kazakhstan’s state-run Kazatomprom, the world’s leading uranium mining company, cut its output for 2025 by 20% due to project delays and not enough sulfuric acid on hand to pump new uranium supply.

In Wall Street terms, the company “missed.”

That action catalyzed a mad scramble for countries to diversify and to consider alternate strategies for their uranium sources. The move pushed uranium prices off near-term doldrums.

This is the second major uranium supply shock to happen in the past two and a half years.

The escalation of the Russia-Ukraine war in February 2022 forced the U.S. and its allies to reconsider their energy resource supply chains away from Russia and its partners.

The geopolitical fallout led to an intensified focus on one critical type of power – nuclear energy.

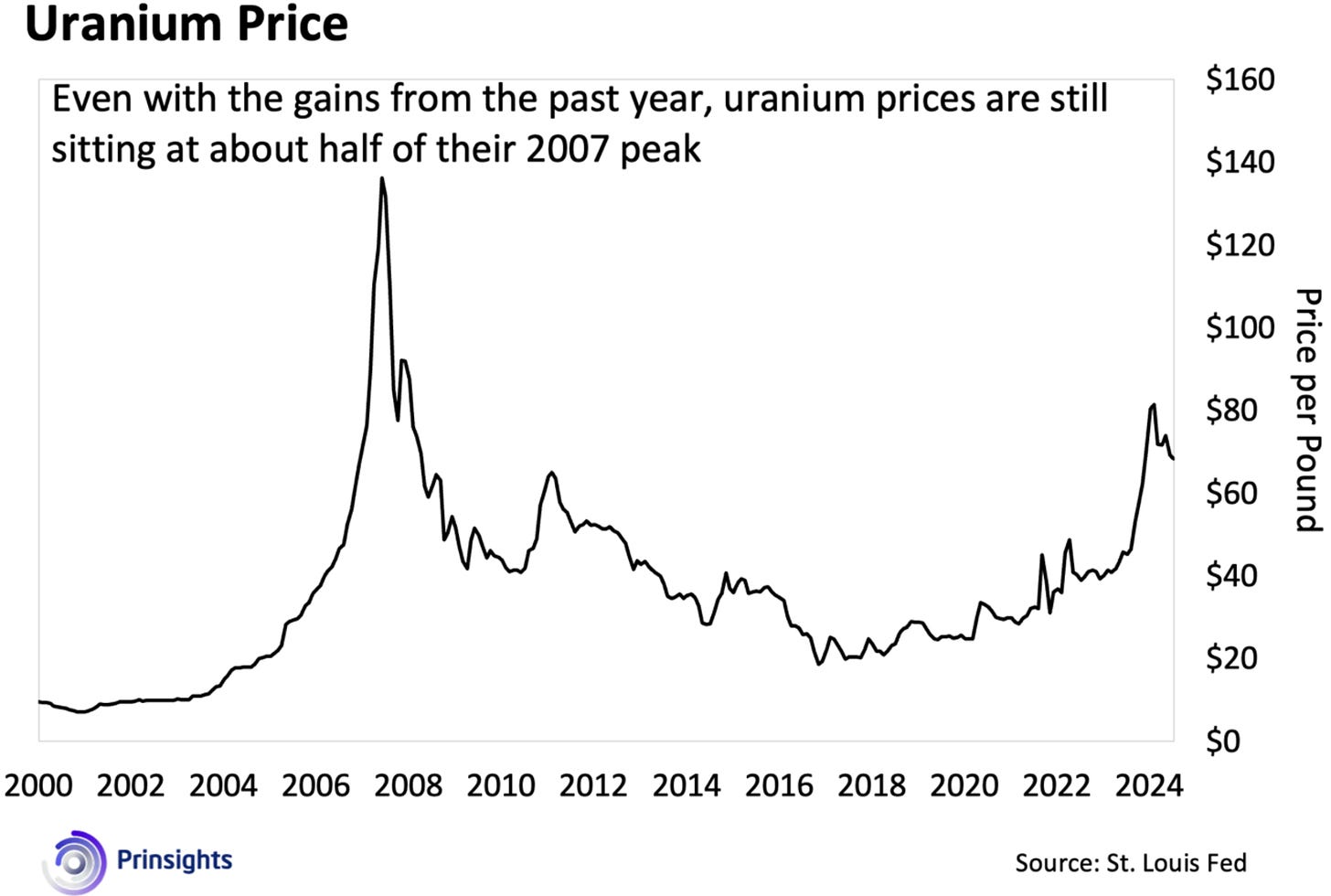

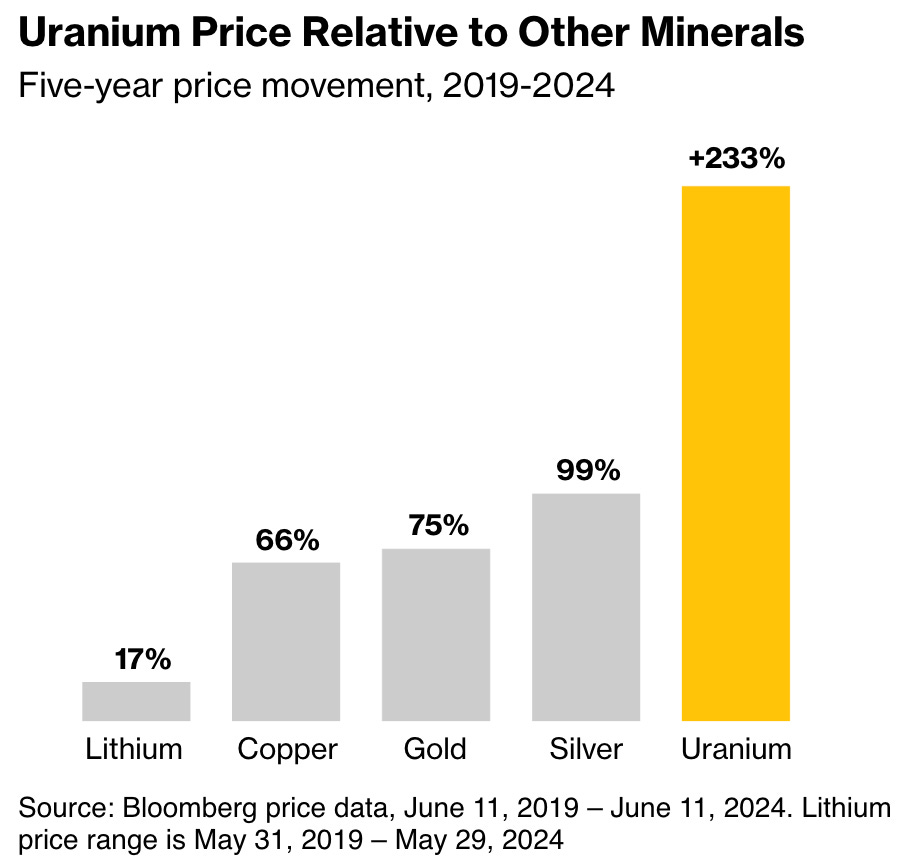

Already, the price per pound of uranium which fuels nuclear power, has more than tripled over the past four years and outperformed better known elements such as gold, silver, and copper.

The battle for uranium is set to skyrocket.

Let me explain.

Keep reading with a 7-day free trial

Subscribe to Prinsights with Nomi Prins to keep reading this post and get 7 days of free access to the full post archives.