The Transformational Metal Hiding in Plain Sight

Here's the key metal that investors are going to be paying attention to next.

When French Emperor Napoleon III hosted state dinners in the mid-1800s, his most honored guests dined with aluminum cutlery. Everyone else made do with gold and silver.

Back then, aluminum was among the rarest and most prized materials on Earth. It was worth more per ounce than gold itself. The French government even held bars of aluminum as part of its national treasury, right alongside its gold reserves.

Then, in 1886, scientists discovered how to produce aluminum at scale. Within 15 years, the price collapsed from over $550 per pound to just 20 cents. Aluminum went from emperor’s silverware to soda cans in a single generation.

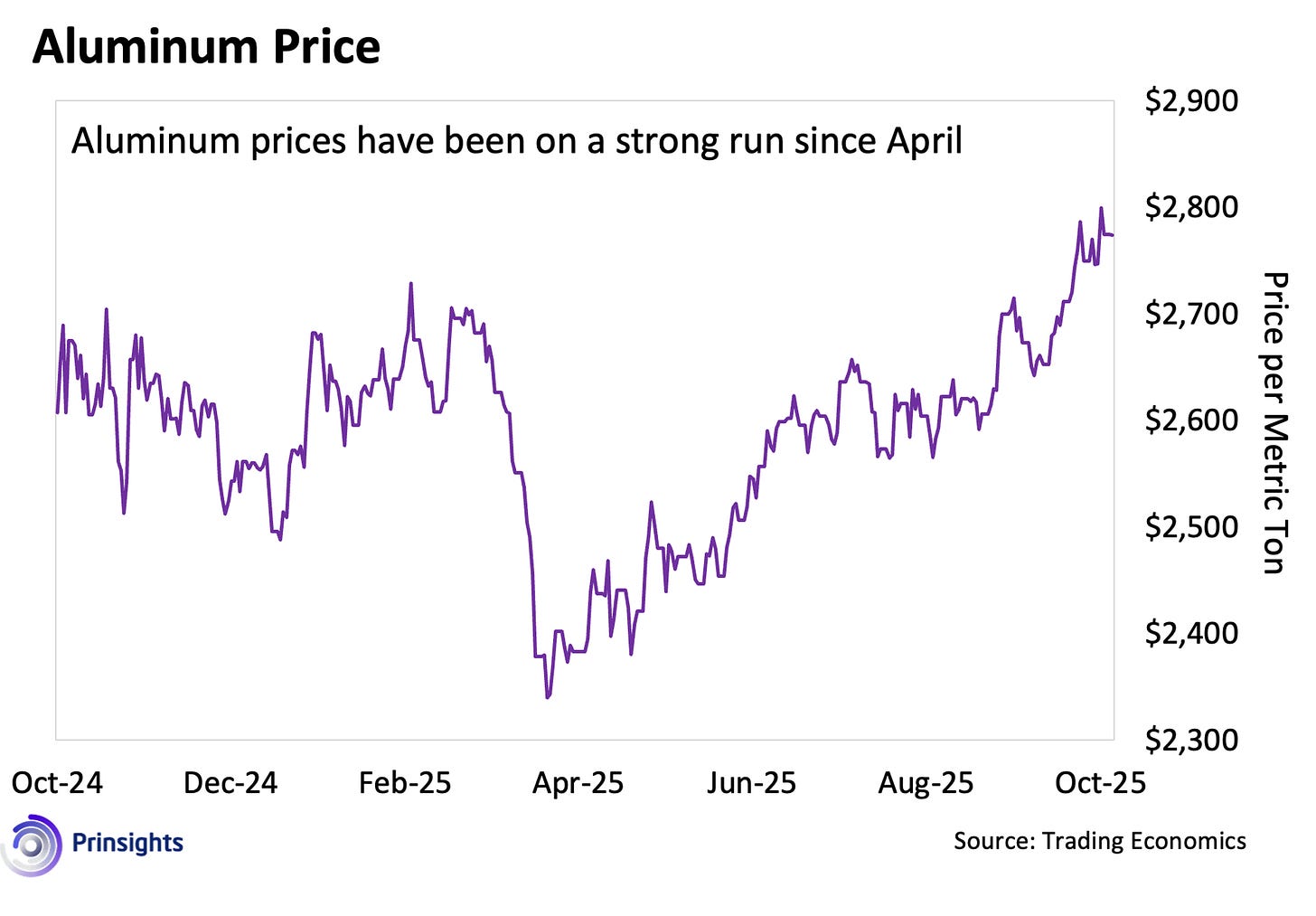

That dramatic fall made aluminum so common that we barely think about it anymore. But here’s what most investors are missing: aluminum is entering a new era, and now it is moving toward something potentially even more valuable. Aluminum is now in the crosshairs of geopolitics and trade wars.

That’s why aluminum prices have quietly hit 3-year highs this year.

The Infrastructure Surge No One’s Pricing In

We’re entering what might be the largest infrastructure buildout in modern history. Not just in one country, but globally.

Electric vehicles need aluminum for battery enclosures and lightweight body structures. A typical EV contains roughly 400 pounds of aluminum, or more than double what a traditional car has.

The electrical grid needs aluminum for transmission lines. Its main benefit is that aluminum is 30% lighter than copper while exhibiting comparable conductivity. This makes it critical for long-distance power transmission. Meanwhile, data centers and AI infrastructure are driving unprecedented electricity demand, and with that, accelerating grid expansion and transformation.

The aerospace sector also relies on aluminum-lithium alloys that deliver superior strength-to-weight ratios. Global aircraft deliveries are projected to double over the next 20 years as emerging markets expand air travel and aging fleets need replacing.

Even spacecraft depend on aluminum. From SpaceX to NASA, rocket designs rely heavily on aluminum’s unique combination of strength, light weight, and thermal properties.

We have one last opportunity to put on your radar. On November 12, Metals and Miners will host a marquee live 3-hour event – and you won’t want to miss it! I’ll be joining an all star panel where we’ll be focused on getting positioned ahead of the curve as we enter 2026.

And then there’s packaging. Aluminum cans are infinitely recyclable, lightweight, and increasingly preferred by environmentally conscious consumers over plastic. The beverage industry’s shift toward aluminum is accelerating, with global can consumption growing 3-4% annually.

The Supply Side Squeeze

Now here’s where demand meets a hard wall of reality – and where opportunity has emerged for investors seeking returns.

Aluminum smelting (the process of extracting pure metal from ore by heating it to a high temperature) is extraordinarily energy-intensive. Producing one ton of aluminum requires about 15 megawatt-hours of electricity. That’s roughly the amount of power an average American home uses in 18-months.

This makes aluminum smelters incredibly sensitive to energy costs. Over the past few years, energy price spikes forced smelter closures across Europe and North America. The United States now operates just four aluminum smelters, down from the dozens it had in previous decades. That represents a 60% loss of domestic production capacity.

Europe’s situation is even more dramatic. Since the energy crisis began, European aluminum output has fallen by more than half since 2021. Some of those smelters will never restart. The capital costs and energy commitments required to bring a smelter back online are simply too high in today’s market.

Meanwhile, the raw material situation is tightening. Alumina prices, or aluminum’s key raw input material, have nearly doubled in 2024, reaching record highs of around $600 per ton. That’s squeezing profit margins for smelters globally and creating an additional disincentive for capacity expansion.

And in June 2025, the final piece of the supply puzzle fell into place: China’s aluminum production capacity reached 45.7 million tons.

Why is that a big deal?

Since 2017, China has imposed a national cap of 45 million tons on aluminum smelting capacity. It’s not a soft target or a yearly quota – it’s a hard structural limit. Under this system, known as “capacity swapping,” companies can only add new smelters if they shut down old ones of equal size. The idea is to control overcapacity, energy use, and emissions, which means China can’t simply ramp up production to meet rising global demand.

In other words, as of June, China effectively hit its ceiling. There’s no room left to grow production unless existing smelters are replaced.

That’s a big deal because China produces roughly 60% of the world’s aluminum. When the world’s dominant producer hits its ceiling, it sets a hard cap on future supply growth. For now, relatively weak domestic demand has kept exports flowing, but that’s a temporary condition. With Western smelters still offline due to high energy costs and demand rising across multiple sectors, and regions, the market is tightening fast. That means prices will rise, as well.

What This Means for You

So, how are investors seeking returns to take advantage of this growing supply vs. demand gap?