JUNE ISSUE - The Energy Producer Set to Win the Pipeline Paradox

Here's a key company at the center of the energy transformation and the analysis showing why they're worth your consideration right now.

Just before summer officially started, I went to a rivalry game between the Dodgers and Giants for a home game in LA. I always go to a game in mid-June. It’s a sliver of the seasonal shift I’ve come to mark. Even in California, you can feel the turn. Maybe it’s habit from my New York days, when Q2 heat hit Wall Street, too.

There were 51,548 people in the stadium. The air buzzed, the sky cracked open into a perfect LA sunset. You could feel the heat carrying, soaking into concrete, lingering past dark. It signals summer is here and setting in from coast to coast.

I also always know summer’s coming when my oldest dog, Charley – a sturdy 85-pound Griffon with strong opinions – starts cutting our morning walks short at Runyon Canyon. He’ll go up a little ways, then stop and turn around.

Even in LA, where summer heat used to take its time, the spike comes earlier now. That heat drives up energy demand fast, too. And this summer, forecasts are already pointing to a record need for air-conditioning loads that come at a time of greater electricity and gas demands across the United States. It’s similar across the globe.

Domestic Demand Tightens as Global Demand Pulls

Now, we’ve explored at length the very real demand that the grid is and will have for electricity. But a key component that can often be overlooked or undervalued in the energy transition is natural gas.

Natural gas is crucial for four key reasons in particular:

First, and perhaps most importantly, it delivers during periods of extreme demand and offers a reliable and flexible supply for energy generation.

Second, it is a bridge fuel that replaces other finite and often hazardous fossil fuels.

Third, it leverages infrastructure already in place and allows for the adaptation and innovation of new energy sources like hydrogen.

Fourth, and an area that’s now critically important to the current White House, it places an emphasis on energy security – that’s because the U.S. has an abundance of natural gas that can support energy generation efforts from coast to coast.

These key reasons are essential to factor in because natural gas-fired generators are already ramping up across the South and Midwest in the U.S. in anticipation of a summer heat wave that already flared in May.

The Electric Reliability Council of Texas (ERCOT) pegged peak demand at 84 gigawatts during a mid-May 2025 heat – a new all-time high, compared to 77 gigawatts a year earlier.

That kind of early pressure translates directly to higher gas burn, especially during late afternoon hours when solar fades, but air conditioners need to keep running.

Patterns like this prompted the EIA's June 2025 Short-Term Energy Outlook to forecast a rise in demand for liquified natural gas (LNG) into the summer months.

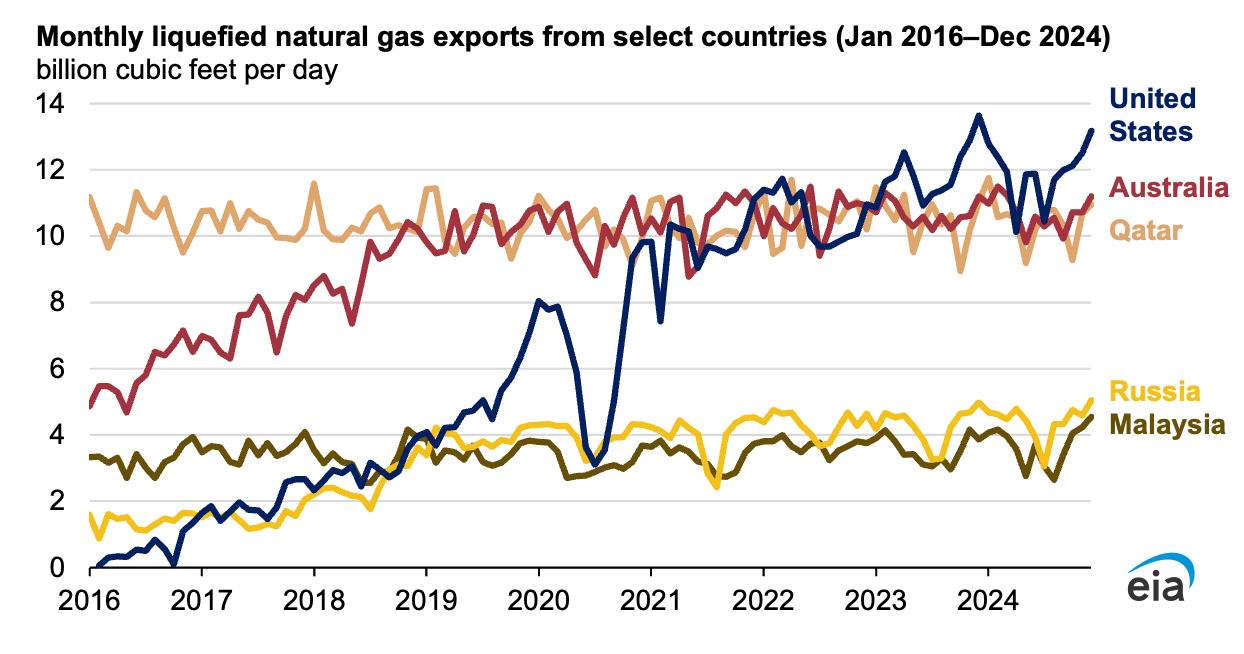

U.S. LNG exports are also expected to increase. That will put extra pressure on existing LNG supplies. Today, the U.S. is the biggest LNG exporter on the planet. It exported 11.9 billion cubic feet per day (Bcf/d) of LNG in 2024. To put that into perspective, the U.S. barely exported any LNG in 2015, as you can see in the chart below:

The hotter it gets, the greater the LNG demand. Domestic forecasts show gas demand rebounding as temperatures rise and utilities have to lean heavily on dispatchable generation.