Permanent Distortion: Why the Market’s Record Rally Hides a Weakening Economy

Here's what the distortion in the

Wall Street is celebrating after the S&P 500 hit a fresh record high of 6,173 on Friday, June 27, despite dodging military strikes in the Middle East, the latest round of tariff battles, and the Federal Reserve's reticence. While that number signals strong investor enthusiasm, the economic reality beneath the surface is much more complicated.

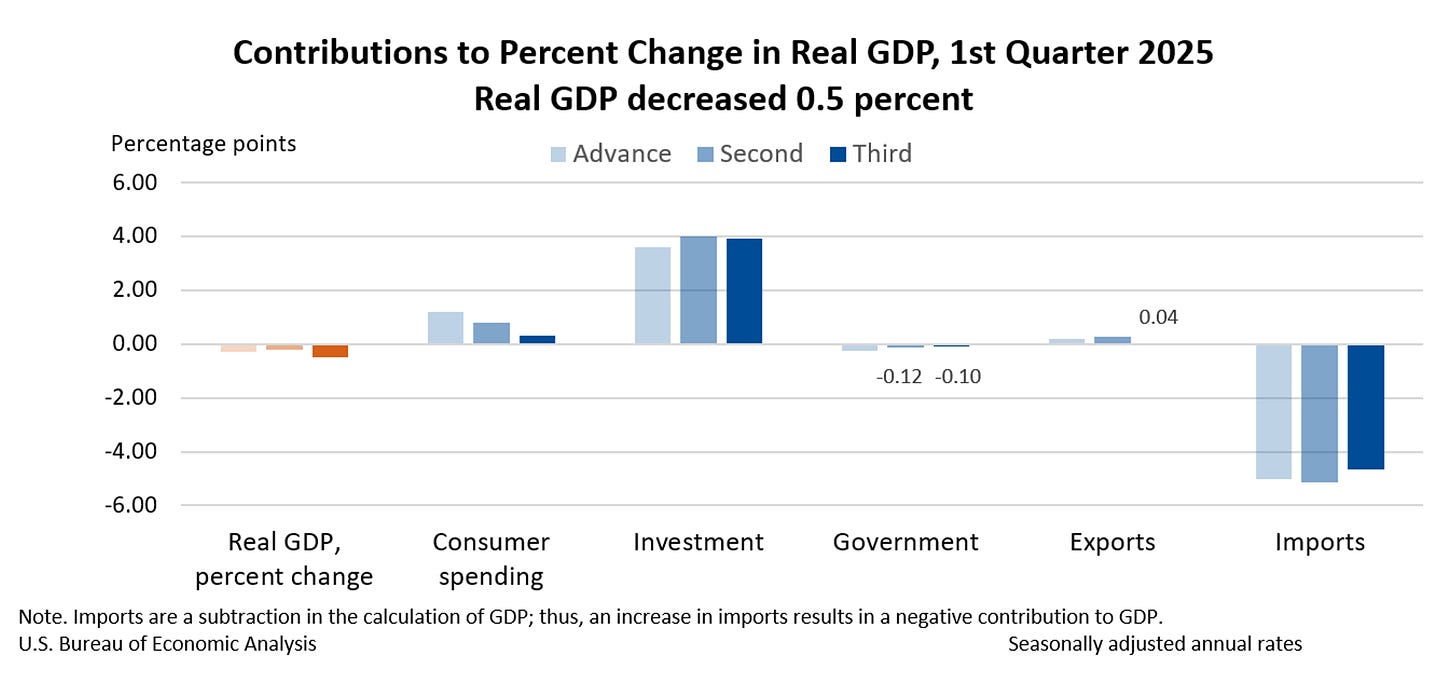

First, the U.S. economy (measured by GDP) was revised down from -0.2% to -0.5% for the first quarter of 2025 in the third revision of that figure. That’s the first quarterly decline since the post-pandemic rebound. The drop from the second estimate was primarily due to downward revisions in consumer spending and exports.

When we compare that to the last quarter of 2024, which saw 2.4% growth (and adjusted for inflation), we’ve had over a year of declining or stagnant GDP prints.

Yet, there’s even more brewing beneath the surface.

Consumer spending, which accounts for roughly 70% of GDP, dropped 0.3% in May, which is the first decline in more than a year. This all comes at a time when inflation remains persistent. The Fed’s preferred inflation gauge, the core Personal Consumption Expenditures price index, rose 2.7% year-over-year in May, which exceeded the Fed’s 2% target.

The price index for gross domestic purchases rose by 3.4% during the first quarter, an upward revision of 0.1% from the prior estimate.

Separately, the personal consumption expenditures (PCE) price index rose 3.7%, while core PCE, excluding food and energy, rose 3.5%. Those figures were both 0.1% higher than their prior estimates. That means inflation remains obstinate.

Wages have barely kept up with inflation, rising by 3.1% over the past year, eroding real buying power. And debt ticks ever higher, like an irritable metronome.

The household debt service ratio, which is the share of disposable income spent on debt payments, climbed to 13.5% in Q1 2025. That’s the highest level in 13 years. Total household debt hit an epic $18.2 trillion in Q1 2025, up from $18.0 trillion in Q4 2024. Mortgage balances rose $199 billion to $12.8 trillion, while student loans increased by $16 billion to $1.63 trillion.

Unfortunately, housing costs are contributing to challenging financial and economic conditions in the U.S. In particular, as rents continue to rise faster than incomes, consumers are seeing their budgets being stretched to a breaking point. Nearly half of all renters now spend over 30% of their income on housing. The trend is exacerbating financial pressure for households across almost all income levels – yet for those with low to middle incomes the impact is weighing on them the most.

Meanwhile, despite the recent trade agreement between the U.S. and China signed on June 26, 2025, trade tensions persist. That keeps pressure on supply chains and freight costs which are up approximately 10–20% above pre-pandemic levels due to geopolitical friction, fuel prices, and lingering logistical challenges.

The labor market is reflecting strain. Unemployment ticked up to 4.2% as some sectors slowed hiring or hit workers with sweeping layoffs. Corporate earnings were mixed, with companies citing cost pressures and uncertainty. And manufacturing investment fell 1.5% in Q1 2025, signaling caution among businesses that could lead to further lay-offs in the near-term.

When evaluated together, this data shows a landscape where every day Americans continue to face rising costs and personal financial stress. Household debt now sits at record highs, and economic growth is slowing – compounding the challenges posed by persistent inflation, generationally high grocery costs and escalating bills overall.

Why Markets Keep Climbing Despite Weak Economic Signals

Yet, even as the economy appears to be faltering, markets continue to rise.

You see, investors are pricing in hopes for a Fed rate cut due to dampening economic factors despite lingering inflation. The Fed has held interest rates steady between 4.25% and 4.5% in 2025 after 100 basis point of cuts in 2024, following previous hikes designed to fight inflation without sparking recession.

This gap between market highs and economic pain is what I call Permanent Distortion. In my book, Permanent Distortion: How the Financial Markets Abandoned the Real Economy Forever, I explore how, since 2008, central banks expanded their balance sheets from roughly $900 billion to over $9 trillion at the height of the 2020 pandemic, flooding markets with liquidity that Wall Street and financial entities use to fuel their speculative actions.

Currently, the Fed is holding about $6.8 trillion of assets on its books that act as a market liquidity cushion for Wall Street. To put that into perspective, the figure more than $2 trillion higher than what they held at the height of the financial crisis of 2008.

This signals that there is a significant shift between what’s happening on Wall Street and the realities of Main Street. That’s important for folks like workers, investors, retirees and families because the economic conditions impact budgets, savings and household stability.

It also opens the door for hard assets and companies building real things. That’s because hard assets and true infrastructure can withstand nearly any sort of financial storm. Assets like these continue to hold intrinsic value because they’re rooted in actual supply and demand for long-term economic and infrastructure development. These sectors remain critical components of a diversified portfolio, offering resilience amid market volatility.

At Prinsights, we continue to build, research and deliver recommendations for a model portfolio that’s overweight in commodities and companies with long-term building projects that are in motion. It is not enough to be aware of the Permanent Distortion in the markets – we must prepare and design a model portfolio that’s ready to navigate the wide array of risks and volatility that continues to emerge around the world.

As we enter our second year tomorrow, we are so proud that our Prinsights Pulse Premium model portfolio has delivered quality results based on these strategies. To our Premium readers, we sincerely thank you for being a part of this dynamic and global community.

If you’re not a Premium reader yet and you’d like to see our detailed research, analysis, updates and deep dives that are delivered each month, you can join here now. We’d be glad to have you aboard!

Nomi, Too bad for many they don't follow you. You are of great character and fiscally responsible.