NOVEMBER ISSUE – Fintech Frenzy: The Global Powerhouse Unleashing a Financial Giant

After returning from the G20 in Rio, here’s what my research is signaling as an emerging opportunity.

Happy Thanksgiving to those in the U.S and around the world!

There’s a transformative global phenomenon changing money as we know it.

I’m not talking about Bitcoin, which keeps blasting past new highs. Although the blockchain technology underlying Bitcoin does play a significant role.

It’s a story that unfolded at the recent G20 in Rio de Janeiro, Brazil.

I began researching it when I traveled to Brazil this Spring to stay ahead of the trend.

You see, because Brazil hosted the annual G20 conference this year, its leaders played a critical role in shaping the summit’s agenda months in advance.

As some of you know, I have a vast network of long-standing contacts in Brazil. The network enables me to gain insights into what leaders in the world’s 10th largest economy are thinking. I earned my PhD from one of Brazil’s most prestigious universities and studied under the same department as a former president of Brazil.

So, back in April, I visited the Ministry of Finance in Brasilia, Brazil’s capital. While there, I spent several hours with Dr. Cristiano Duarte, a senior macroeconomist at the Ministry of Finance’s Economic Division. We discussed topics from the energy transition to monetary policy. That’s when I discovered that digital finance and cross-border payment systems would be a hot topic at the G20 summit.

He also underscored Brazil's momentum in digital finance. The official revealed that Brazil is motivated to be a leader in the space – including in the development of the Digital Brazil Real, or the Drex and its underlying Ethereum blockchain technology.

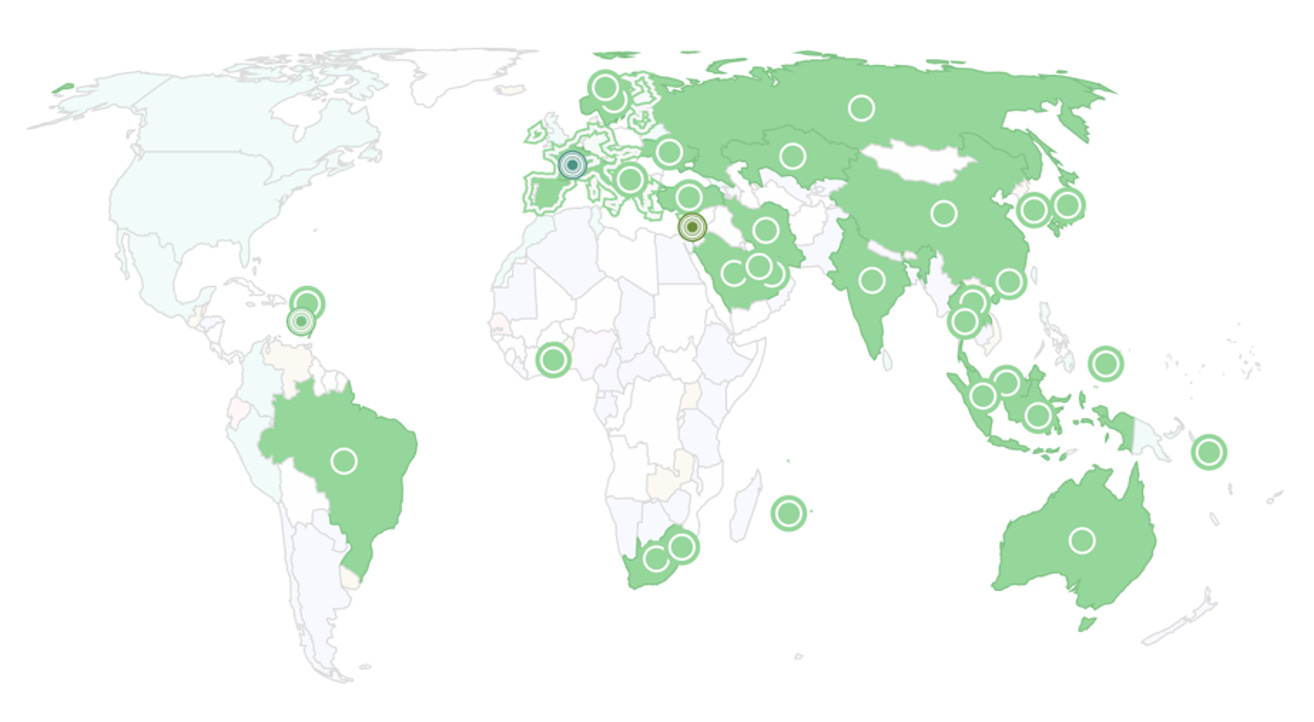

According to the Atlantic Council, Brazil’s central bank is one of 134 Central Bank Digital Currency (CBDC) efforts in some stage of CBDC development worldwide. As of September, Brazil is also one of 44 countries curating a CBDC pilot program.

Every original BRICS country has launched a CBDC pilot program. But, since the Russian invasion of Ukraine in February 2022 and subsequent G7 sanctions on Russia’s financial transactions, the number of cross-border pilot CBDC projects has doubled.

Today, 13 countries are working on cross-border pilot projects, including mBridge. The mBridge platform connects banks in China, Thailand, the UAE, Hong Kong, and Saudi Arabia. It is now set to expand to more countries.

Other notable projects are in advanced stages of development. The digital yuan (e-CNY) is the largest CBDC pilot globally. In June 2024, its total transaction volume hit 7 trillion e-CNY ($986 billion), quadrupling the amount in June 2023.

Other systems, such as BRICS pay, which we detailed for you last month, are based on blockchain technologies and spanning multiple currencies. These systems are meant to challenge the dollar-centric SWIFT payment system.

Digital currencies and the payment systems that use them can potentially access and store more user data than other fintech companies can, all while operating faster and on a global scale.

But there’s another type of payment system worth your attention. Once combined with a CBDC, it would enable a mix of CBDCs and financial payments from individuals.

Keep reading with a 7-day free trial

Subscribe to Prinsights with Nomi Prins to keep reading this post and get 7 days of free access to the full post archives.