Copper Just Flashed a Market Signal Everyone Missed

Here's what's unfolding right now in the copper markets and what you should know.

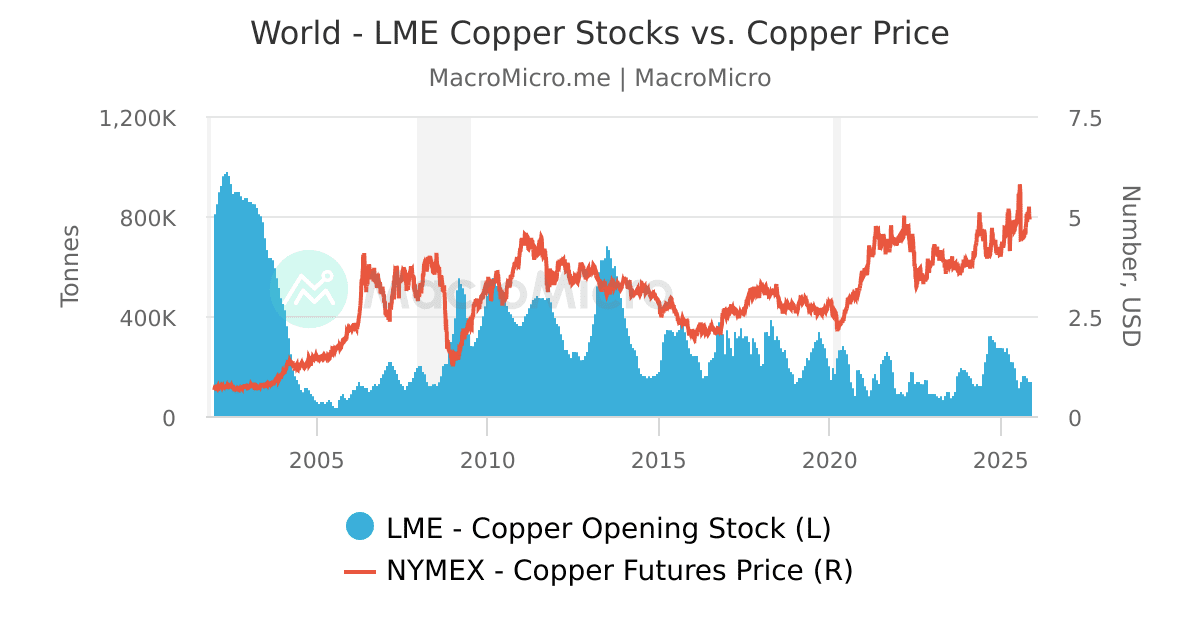

Copper rarely moves in dramatic ways; instead, it takes incremental shifts that make sense if you’re tracking them day by day. Late last week, the pattern of rising copper prices and depleting inventories pointed to a strong sign of copper demand exceeding available supply.

This time was different from the summer, when intraday copper prices spiked to $5.95 per pound on news that the White House was levying 50% tariffs on certain derivative copper products. Indeed, there was no new news of such magnitude last week. That’s what made the price versus inventory gap so much more remarkable. And why it’s worth your consideration as we detail below.

The London Metal Exchange’s (LME) Friday print showed copper warehouse inventories at 135,725 tons. That figure was down from roughly 136,175 tons the day before and off more than half a percent from mid-week levels. In copper, this shows a tightening market. But that’s not all.

Inventories are only a fraction of the 26-28-million-ton global refined market. When the cushion is this thin, it means that a 400 or 500-ton move, say, of a producer going offline, represents roughly one-quarter of one day’s global consumption disappearing from available buffers.

That may not sound like much, but because inventory already sits near multi-year seasonal lows, these small weekly declines carry more informational value than headline supply numbers.

It’s also important to examine how prices behaved. Sometimes, that’s where the strongest signals emerge.

Cash copper settled near $5.05 per pound on the NYMEX exchange and $10,851 per ton on Friday, November 14, on the LME, having held that range all week. The metal had more than enough weak macro factors to justify slight price declines, such as China’s weak factory data, soft Eurozone growth forecasts, and broader risk for markets digesting U.S. interest rate expectations by the Fed going into the end of the year.

Yet the gap between copper prices and inventories continued to widen across all major copper exchanges. Markets in true surplus don’t behave this way. When supply is solid, inventories rise quietly and prices drop. That didn’t happen.

What we saw instead was a tight physical market absorbing macro noise without buckling, and that kind of behavior precedes re-pricing episodes.

In other words, copper is showing intensifying signs of tighter underlying conditions.

The Hidden Term-Structure Clue

The forward curve added another layer of evidence. The LME showed spot copper trading at a slight premium to three-month futures. This phenomenon is called a backwardation in Wall Street wonk.

What you should know is that this is a pattern you see when the market is anticipating less supply. It implies that market participants, ranging from traders to fabricators to intermediaries, are all willing to pay more for metal today than 90 days from now.

These curve structures tighten when the physical market is more concerned with getting supply now, rather than any headline macro sentiment. And, again, the key detail is timing.

There was no major supply disruption last week. No new producer shutdown. No unexpected change in Chinese import activity. When the curve tightens without a new catalyst, the underlying explanation is almost always the simplest one: physical availability is contracting.

It means traders and end producers see supply constraints and are adjusting their positions accordingly. Combine that behavior with the inventory pull-downs and firmness in spot pricing, and the message becomes clearer.

Copper is being slowly squeezed.

Why this Matters Heading into Our Big Copper Week

Now, we’re heading into a major copper week of our own here at Prinsights.

Tomorrow, we’ll take a deeper dive into copper’s behavior. Then, on Thursday, we’re dropping a packed Founders+ monthly issue for November. It includes our first semi-annual model-portfolio update, a bonus spotlight CEO interview that looks into a key corner of the uranium space, and an under-the-radar domestic copper miner poised for lift-off due to these signals.

Again, it’s worth considering that the market itself just showed us a small inventory decline at already-compressed levels, a spot price that held in when it had every reason not to, and a forward curve leaning backward, in a week with no new disruptions.

What all this confirms is that the market is starting to behave in a way that aligns with copper’s structural reality.

When you see that alignment, even in small increments, it tells you that the underlying forces we’ll map out this week are tailwinds to copper prices and miners.

We’ll delve into all this and much more in our analysis coming tomorrow and an actionable recommendation coming Thursday.

If you haven’t joined our Founders+ community, now is the perfect time to join.